2022 Crypto Bear Market: Time to Pay Attention, Bitcoin Bottom is Here

Soon enough, your pain and anguish will be replaced by happiness. You will be singing in the rain again. The time has come for the Bitcoin bear market to end as the global economy is showing less inflation, especially in the U.S., the NASDAQ market rallied when U.S. CPI data came out showing slowing inflation. This only means the U.S. Federal Reserve (Central Bank) will most likely be less hawkish in their interest hikes (higher interest hikes = more cost of borrowing money = less business expansion) this coming 2023.

Since early this 2022, BTCUSD has been constantly showing a descending wedge pattern which is a bullish type (the opposite is ascending wedge). However, BTC breaks out of it and re-enters so we will be looking at other signals instead.

By the way, when I was writing this article, the FTX exchange went bankrupt and is now closed with user’s funds along with it. I’m sorry it happened but I’m sure the victims will get justice when Sam Bankman-Fried is jailed and funds are returned.

I recommend Binance which is the largest and the safest spot and derivative exchange. Or you could try Bitmex which used to be the go-to exchange for margin trading. If you want less KYC procedures and a bit of copy trading, try Bybit, the interface is very familiar to any crypto trader.

Volume Profile

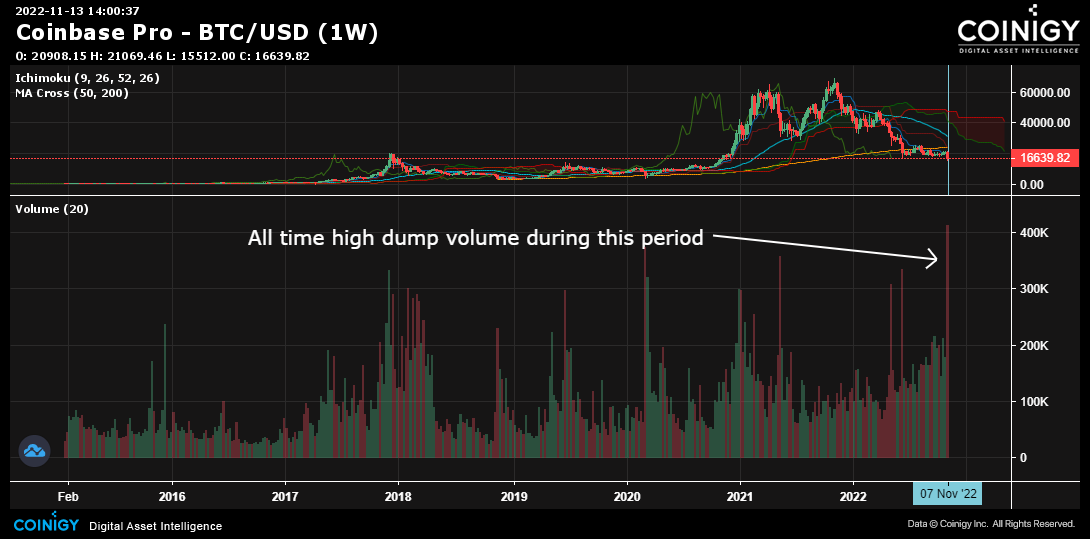

The November 7, 2022 week is the bottom of the 2022 Bitcoin downtrend. Back in January 12, 2015, popular exchanges, Bitstamp and Bitfinex made an all-time-high weekly dump volume.

Last week, Coinbase made ATH weekly dump which means $15,512 is the bottom. Also we cannot count Binance because trading is fee-free which could be manipulated by

volumizer bots or FTX that just went under.

Also last week was the current highest bitcoin dump volume, more than the Covid dump of March 2020, yet it was shallow, meaning the bid side has more liquidity.

It could spell the final capitulation dump.

Trade Signal

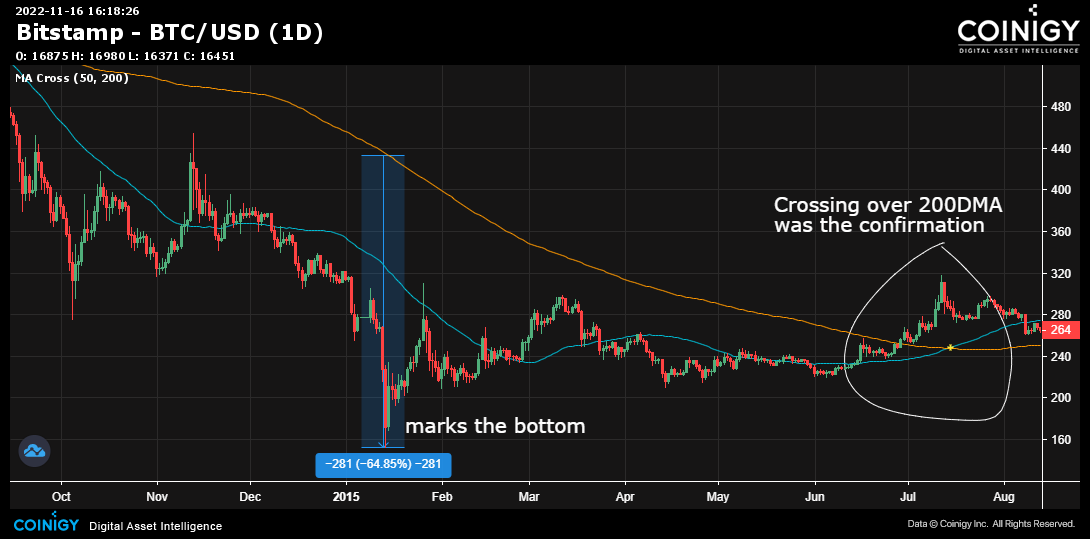

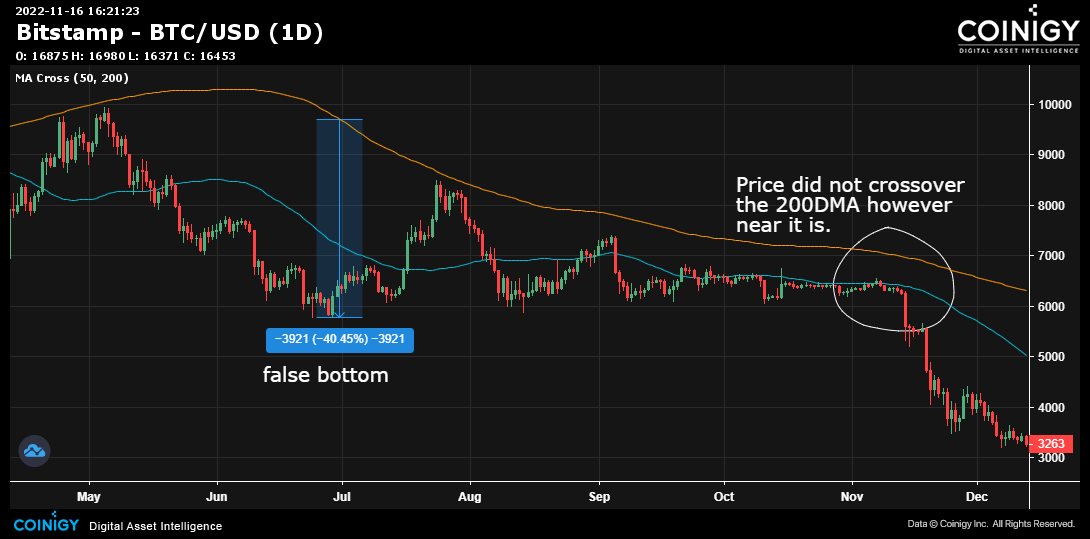

For a cautious trade entry, here’s a definite plan. BTCUSD always marks bottom with biggest distance away from 200-day Moving Average and confirms it with a crossover with price over the 200-day Moving Average. I’m guessing confirmation of bottom will happen around December 15, 2022 at $20,412 or maybe earlier time.