Avoid using Martingale strategy at all costs

So… I got liquidated when after Elon Musk-inspired pump to $57,000 Bitcoin crashed to $50,000-ish. Basically, I got liquidated when I kept doubling my losing long position. I should have cut losses at a certain price level. The funny thing is that the initial position is small, but then it ballooned because I used the extremely dangerous Martingale strategy.

Martingale - All or nothing and all risk

I never learned my lesson. I’m always falling into the same Martingale trap after so many failed Martingale set-ups. The first time was a gambling joint in Makati Avenue where I used my father’s money to bet in a clandestine casino. Jeez, it should have been enough of a lesson. The second time is JustDice with small amounts; the third is Bustabit (I lost 2 btc here, but a bitcoin was less than $300 then). And now with Bybit derivative exchange!

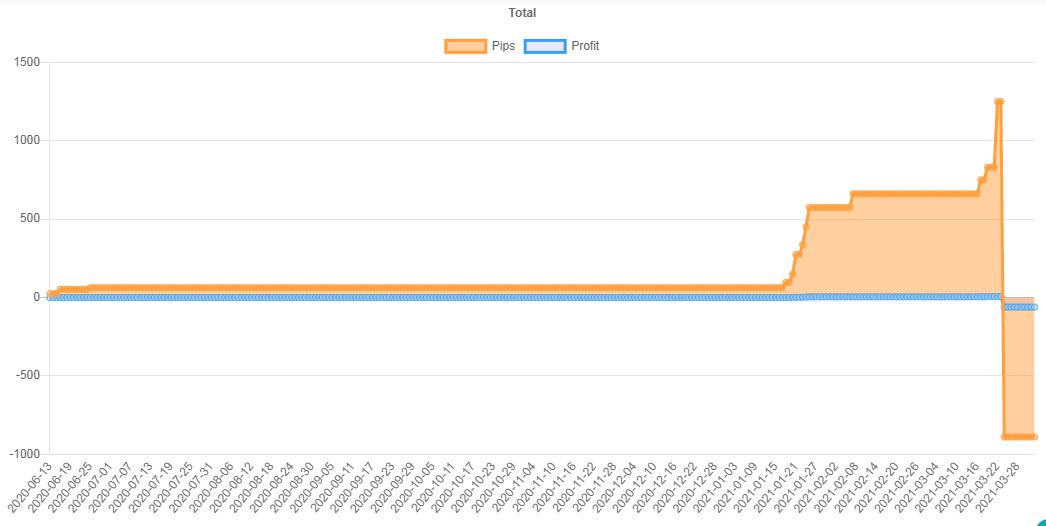

Gladly, the recent fuckup in Bybit was only bonus money that can’t be withdrawn anyway. Nevertheless it is a $74 lesson that will serve me in future TA. I also remember the Bybit trading bot that also used Martingale. The profits were good in two months but then bam! One mistake and all crashed down.

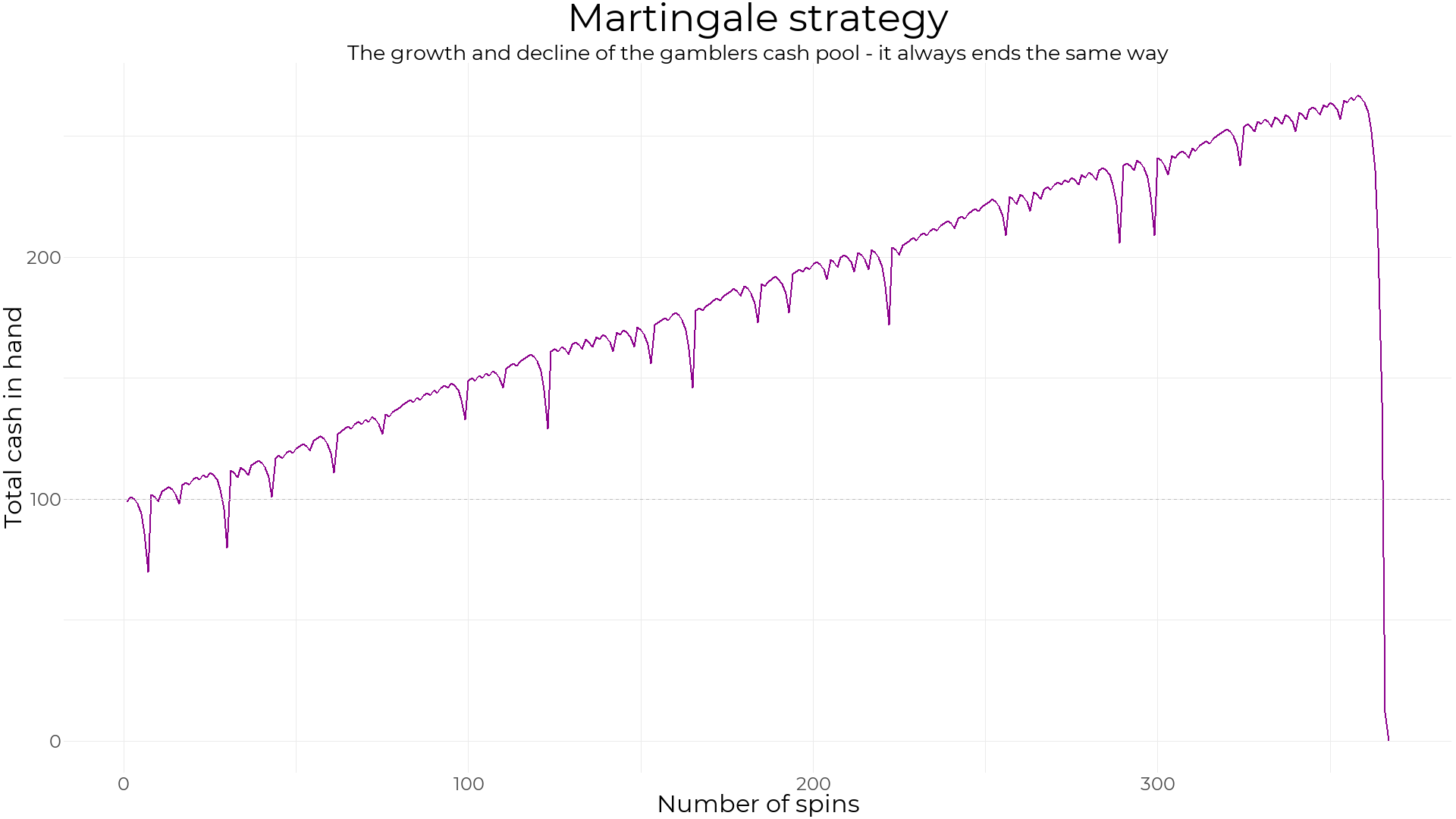

All Martingale progression looks like the chart below - no exceptions.

Martingale is the antithesis of letting your winners run and cutting your losses quick. In the Martingale strategy, you stick to the initial position size and target and then if the trade goes against you, you double your position. So basically, you cut potential profit when it could be bigger but you will not realize small losses and instead increase potentially much bigger losses.

Regarding dollar-cost-averaging strategy (DCA), it is different from Martingale because with DCA, you already have preset conditions to buy and buy more at a lower level - unlike Martingale which is doubling every position exponentially.

Don’t do it! Martingale system will rekt you. Why not try free Bitcoin copy trading?

By the way, some of the ideas written here is obsolete. Times and strategies change.

The risk-to-reward ratio strategy written here is definitely a superior strategy. The post has links to more articles on the subject.

Other observations

Being liquidated after so many years since the last time reminded me that knife catching is a riskier proposition than following the trend.

Also I learned with intensity that KDJ indicators can have prolonged oversold/overbought conditions. The secret lies in the pattern and not the numerical value.